Homeowners who sold their homes in the 3rd Quarter of 2015 saw some of the largest gains in the US. According to RealtyTrac, homes sold in this quarter returned gains of 30.2% or an average price gain of $130,593. This includes all homes sold regardless of when home was purchased. The average American moves once every five years. With 41% of markets reporting decreases, we in the DC Metro region are living in an area where, even with our high real estate prices, it is still 17% cheaper to buy a home rather than to rent.

You can read more here at realtytrac.com

Average Price Gain of $40,658 Highest Since Q3 2007 Despite Annual Home Price Appreciation Slowing to 2 Percent in Third Quarter, Slowest During Recovery; FHA Buyer Share Increases While Share of Cash and Distressed Sales Continues to Drop IRVINE, Calif…. Read More »

Tag Archives: Housing Trends

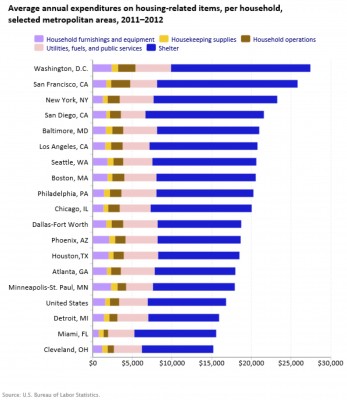

It’s more expensive to live in D.C. than New York

The Washington region is now the most expensive place to live in the country, ahead of New York and San Francisco, according to a recent study by the Bureau of Labor Statistics. We spend more on housing and related expenses. – The Washington Post.

Buying the whole house in D.C.? Those prices keep rising

The median price if a single family home sold in DC last month was $620,000 up 3.3% from a year ago. The median condo price was $410,000 up just 1% since last September – according to GCAAR, the Greater Capital Area Assoc. of Realtors. More homes are on the market, so there is more to choose from. To read more click here.

July-2014 Housing Trends eNewsletter

Welcome to the most current Housing Trends eNewsletter. This eNewsletter is specially designed for you, with national and DC Metro housing information that you may find useful whether you’re in the market for a home, thinking about selling your home, or just interested in homeowner issues in general. The Housing Trends eNewsletter contains the latest information from the National Association of REALTORS®, the U.S. Census Bureau and Realtor.org reports, videos, key market indicators and real estate sales statistics, a video message by a nationally recognized economist, maps, mortgage rates and calculators, consumer articles, plus local neighborhood information and more.

If you are interested in determining the value of your home, click here.

Billionaire: Home Ownership Still the Best Investment

According to John Paulson, a billionaire hedge fund manager, the BEST INVESTMENT POSSIBLE is home ownership. He recently spoke at the “Delivering Alpha” conference presented by CNBC and Institutional Investor, Paulson said “I still think, from an individual perspective, the best-deal investment you can make is to buy a primary residence that you’re the owner-occupier of. Today, financing costs are extraordinarily low. You can get a 30-year mortgage somewhere around 4.5 percent. And if you put down, let’s say, 10 percent and the house is up 5 percent, which is the latest data, then you would be up 50 percent on your investment. And you’ve locked in the cost over the next 30 years. And today the cost of owning is somewhat less than the cost of renting. And if you rent, the rent goes up every year. But if you buy a 30-year mortgage, the cost is fixed.”

DC Metro a BEST MARKET for BUYING Residential Property RENTALS

According to RealtyTrac® a leading source for housing data, DC is one of the top 25 best markets for buying residential property rentals.

They just released their Q2 2014 Residential Property Rental Report, which ranks the best markets for buying residential residential rental properties along with the best markets for renting to baby boomers and the best markets for renting to millennials.

With interest rates still at historic lows, this is the time to explore real estate as an investment.

May – 2014 Housing Trends Newsletter

MAY-2014 Housing Trends eNewsletter

Welcome to the most current Housing Trends eNewsletter. This eNewsletter is specially designed for you, with national and local housing information that you may find useful whether you’re in the market for a home, thinking about selling your home, or just interested in homeowner issues in general.

The Housing Trends eNewsletter contains the latest information from the National Association of REALTORS®, the U.S. Census Bureau and Realtor.org reports, videos, key market indicators and real estate sales statistics, a video message by a nationally recognized economist, maps, mortgage rates and calculators, consumer articles, plus local neighborhood information and more.

Please click here to view the MAY-2014 Newsletter Housing Trends eNewsletter.

Home Prices Continue to Rise in April

According to GCAAR* “The average days on market (in DC) was down 21.4% compared to April 2013. The median price for condos remained flat with no change over April 2013, but single-family homes saw a 8.9% increase. Inventory increased 13.6% in April for condos, but supply for single-family homes remained tight as inventory decreased by 5.7%. Contracts increased slightly, 0.9% for condos, and 2% for single-family homes.”

What does this mean for Sellers and Buyers? In April 2013 homes/condos were on the market for 42 days, this decreased to 33 days in April 2014. Even though inventory is increasing for condos, they are selling faster than a year ago. Single family home prices are rising faster than condos.

*GCAAR is the Greater Capital Area Association of Realtors

NPR, Marketplace: TIME TO BUY

Marketplace today talked of the value of buying vs renting. They noted that housing starts are up, and there is a 17 year low in mortgage lending. They implied that the crazy high cost of renting is pushing people into owning their own homes. And rents are predicted to continue to rise. It’s, on average, 34% cheaper to buy in the DC Metro Area than it is to fork over rent, according to Zillow (see earlier post below).

If it’s so awful for renters, why don’t they go out and buy their first home? Savings. It’s hard to save when you are paying such high monthly rent. Our own District government recognizes this.

Just because your mindset says you cannot afford to buy a home, doesn’t mean that is true. Perhaps it’s time to talk with me about programs like DC Open Doors that cover your down payment. Is it time to talk with a mortgage broker so you can a clear picture of how much/little you need to purchase your first home?

Buying is CHEAPER than Renting

Yes. It’s still true, even with the rise in prices of over 10% in the DC area in 2013. According to Trulia, it is 34% cheaper to buy rather than giving your hard earned cash in rent. Trulia has created a great interactive rent vs. buy map.

For their methodology, Trulia compared the average rent and for-sale prices of an identical set of properties in each city, and then considered the present and future monthly costs associated with buying and renting and factored in one-time costs like down payments and security deposits.

They assume that owners have a 4.5 percent rate on a 30-year mortgage, put 20 percent down and will stay in their homes for seven years. If you don’t agree with these assumptions, Trulia has unveiled their own rent-versus-buy calculator, so that you can play around with specific numbers.

Of course, home price appreciation and depreciation affect this. Trulia takes this into account. “In our rent vs. buy calculations, we use a conservative annual home price assumption that ranges between 1.7% and 3.1%, depending on the metro. The reality, though, is that there’s a huge degree of uncertainty about what home prices will actually do, and the cost of buying relative to renting could turn out to be a lot higher or lower than with our conservative baseline appreciation assumption. To see how much uncertainty there is around what could happen to home prices, we calculated the annual home price appreciation for the best and worst seven-year periods over the past 20 years for each metro, using Federal Housing Finance Agency (FHFA) price data.”