Homeowners who sold their homes in the 3rd Quarter of 2015 saw some of the largest gains in the US. According to RealtyTrac, homes sold in this quarter returned gains of 30.2% or an average price gain of $130,593. This includes all homes sold regardless of when home was purchased. The average American moves once every five years. With 41% of markets reporting decreases, we in the DC Metro region are living in an area where, even with our high real estate prices, it is still 17% cheaper to buy a home rather than to rent.

You can read more here at realtytrac.com

Average Price Gain of $40,658 Highest Since Q3 2007 Despite Annual Home Price Appreciation Slowing to 2 Percent in Third Quarter, Slowest During Recovery; FHA Buyer Share Increases While Share of Cash and Distressed Sales Continues to Drop IRVINE, Calif…. Read More »

All posts by John McCracken

What to watch in the Washington-area housing market this year – The Washington Post

How to stage a home on a budget | Inman

For My Home

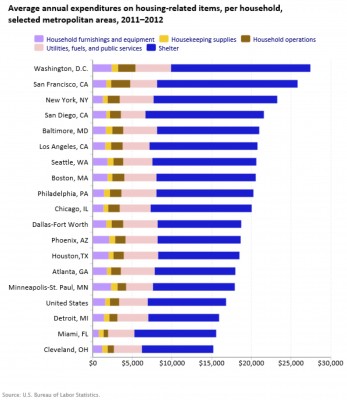

It’s more expensive to live in D.C. than New York

The Washington region is now the most expensive place to live in the country, ahead of New York and San Francisco, according to a recent study by the Bureau of Labor Statistics. We spend more on housing and related expenses. – The Washington Post.

Buying the whole house in D.C.? Those prices keep rising

The median price if a single family home sold in DC last month was $620,000 up 3.3% from a year ago. The median condo price was $410,000 up just 1% since last September – according to GCAAR, the Greater Capital Area Assoc. of Realtors. More homes are on the market, so there is more to choose from. To read more click here.

What’s New on the Mortgage Front?

From low down payment options to jumbo loan options for move-up buyers, here’s what a few lenders are offering buyers.

Chase’s DreaMaker loan is geared for low to moderate income borrowers and first time buyers. Funds are available for up to 95% of the home’s value and there is no upfront PMI (Private Mortgage Insurance). In some cases this might be cheaper than an FHA loan.

Chase just introduced jumbo loans with a maximum 85% LTV. With a 740 FICO score, the maximum loan amount is $1.5 million.

Guaranteed Rate is offering 80-10-10 jumbo loans of up to $1 million. You’d put down 10% of the home’s value, with a mortgage for 80% and a second mortgage for the remaining 10%. This would require about 1/8 % more in your interest rate.

HomeTrust Mortgage Corp is offering a Launch Loan. The loan requires only 5% down (which can be a gift), and the PMI will be waived for a nominally higher interest rate os 1/8 to 1/4 %. This can considerably lower monthly payments.

You can read more about this by clicking here.

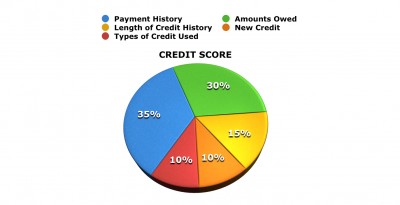

Important Credit Tips to Know Before Purchasing a Home

A higher credit score means better loan options with better rates, that lower your payments and save you money. Your credit score is determined by: payment history, amounts owed, length of credit history, new credit, and types of credit used.

FIVE WAYS TO IMPROVE YOUR CREDIT SCORE

- Keep balances low on credit cards. High outstanding balances in relation to your maximum credit limit can lower your score. For example it is better to have a $2,500 balance on a $10,000 limit, than a $475 balance on a $500 limit.

- Pay off debt. Do not move it around.

- Don’t open up many new accounts in a short period of time.

- If you have a credit card that has a good history, use it. Buy groceries, then pay it off. An inactive card is not helping your credit score.

- If you are deciding to pay off a car loan/student loan early or paying down a credit card, put more money toward the credit card. Why? Car loans, personal lines of credit and student loans are “installment accounts.” The payment is the same every month. Paying these demonstrates being able to handle credit responsibly. Paying a credit card off or down improves your score.

August-2014 Housing Trends eNewsletter

Welcome to the most current Housing Trends eNewsletter. This Newsletter contains the latest information from the National Association of REALTORS®, the U.S. Census Bureau and Realtor.org reports, videos, key market indicators and real estate sales statistics, a video message by a nationally recognized economist, maps, mortgage rates and calculators, consumer articles, plus local neighborhood information and more.

To check on the current market value of your home, click here.

Strategies for Setting a Price for Your Home

Setting the price for your home involves balancing expectations with realistic knowledge of the current market. Research provides some insight into setting the right asking price.

1. Getting too precise means you won’t budge and negotiate. Setting an asking price at $797,485 rather than $800,000 sends the message that you have confidence in the price and will not be very willing to negotiate.

2. Use the number nine. When you are shopping at the store, have you ever asked yourself why everything seems to be priced with 99 cents? $9.99, $39.99, $799.99? Wouldn’t $10, $40 or $800 make more sense? Actually the number nine can be a big influence. Pricing a property at $599,999 rather than $600,000 can subconsciously influence the home buyer. The lower number, even though we are talking about a dollar, just appears much lower. “It’s the way our brain looks at numbers,” according to Michael Seiler, professor of real estate and finance at the College of William & Mary.

3. Going low doesn’t always mean a higher selling price. Though you may create a frenzy of offers, you may find you take a lower offer if it’s an all cash deal.

Selling real estate and getting a solid offer is a delicate dance of strong marketing, informed pricing and exceptional negotiation.

To read more click on this link to be taken to this Wall Street Journal article on Strategies for Setting a Price for Your Home – WSJ.