The New York Times has a great article on Low-Down-Payment Loans. This article focuses on the New York market, but similar programs exist here in the DC Metro area too. Remember when purchasing a house, you are also shopping for a mortgage and the right mortgage broker is a must for a successful transaction.

Mortgages are easier to obtain than many prospective home buyers might expect

If you are “sitting on the fence” about whether it is time to purchase a home, or you just are not sure where you stand in terms of your finances, you are just like most home buyers.

Many people don’t hesitate to do nothing! If you are unsure where you stand in qualifying, give this great article in The Washington Post a read, and feel better. Then give me a call and I’ll put you in touch with great lenders.

The first thing to realize when purchasing a home, is that you are really shopping for two different things: a new home AND a mortgage. As your Realtor, I can recommend banks and brokers based on professional experience.

Affordability and Time

Prices in the DC Metro area experienced a double digit increase in 2013. Interest rates are predicted to continue their slow and steady rise. The chart below shows what will happen to a monthly mortgage payment on a home purchased now, vs being purchased in next year. I am using an 8% increase in home prices over the course of 2014, (which is lower than 2013).

If someone in on the fence in thinking about buying, it is important to strongly consider the ramifications of not acting now.

Interest Rates Going Up or Down?

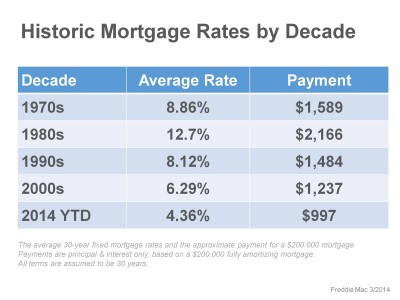

Interest rates are not very likely to return to the lows of 2012 when we were seeing rates in the 3% range for 30-year fixed mortgage rates. Here are the mortgage rates by decade.

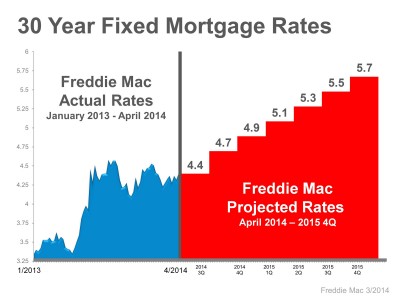

Freddie Mac is projecting an increase in Mortgage Rates for 2014 and 2015.

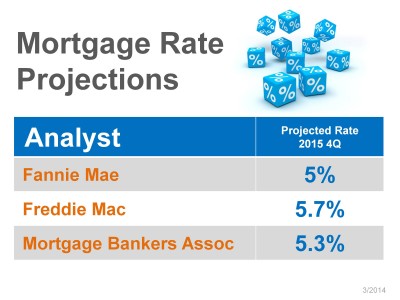

Experts at Fannie Mae and the Mortgage Bankers Association are alerting the market that the expectation is a rise in 30 year fixed rates into 5 to 5.7% range over the next year.

What does this mean for buyers? As you wait to join the homeowner market, the amount of home you can afford shrinks. Buyers who act now benefit from lower mortgage rates and lower home prices, as both are predicted to rise.

NPR, Marketplace: TIME TO BUY

Marketplace today talked of the value of buying vs renting. They noted that housing starts are up, and there is a 17 year low in mortgage lending. They implied that the crazy high cost of renting is pushing people into owning their own homes. And rents are predicted to continue to rise. It’s, on average, 34% cheaper to buy in the DC Metro Area than it is to fork over rent, according to Zillow (see earlier post below).

If it’s so awful for renters, why don’t they go out and buy their first home? Savings. It’s hard to save when you are paying such high monthly rent. Our own District government recognizes this.

Just because your mindset says you cannot afford to buy a home, doesn’t mean that is true. Perhaps it’s time to talk with me about programs like DC Open Doors that cover your down payment. Is it time to talk with a mortgage broker so you can a clear picture of how much/little you need to purchase your first home?

How Buyers Stay Competitive

The market is swift, especially in sought after central DC. Homes, priced right, rarely stay on the market for long. In a market like this, it is the buyer’s turn to engage in Win/Win negotiations.

- It is important to negotiate, to stand above your competition.

- Know what you can borrow; and

- Get There First.

This is a great article in the Washington Post, April 9th that offers great advice on how buyers can stay competitive in our low-supply, high demand market.

Capitol Hill Homes

Buying is CHEAPER than Renting

Yes. It’s still true, even with the rise in prices of over 10% in the DC area in 2013. According to Trulia, it is 34% cheaper to buy rather than giving your hard earned cash in rent. Trulia has created a great interactive rent vs. buy map.

For their methodology, Trulia compared the average rent and for-sale prices of an identical set of properties in each city, and then considered the present and future monthly costs associated with buying and renting and factored in one-time costs like down payments and security deposits.

They assume that owners have a 4.5 percent rate on a 30-year mortgage, put 20 percent down and will stay in their homes for seven years. If you don’t agree with these assumptions, Trulia has unveiled their own rent-versus-buy calculator, so that you can play around with specific numbers.

Of course, home price appreciation and depreciation affect this. Trulia takes this into account. “In our rent vs. buy calculations, we use a conservative annual home price assumption that ranges between 1.7% and 3.1%, depending on the metro. The reality, though, is that there’s a huge degree of uncertainty about what home prices will actually do, and the cost of buying relative to renting could turn out to be a lot higher or lower than with our conservative baseline appreciation assumption. To see how much uncertainty there is around what could happen to home prices, we calculated the annual home price appreciation for the best and worst seven-year periods over the past 20 years for each metro, using Federal Housing Finance Agency (FHFA) price data.”

Home Buyers May Face Sticker Shock This Spring

Home Buyers May Face Sticker Shock This Spring | Realtor Magazine.

As the spring market heats up, more buyers are finding higher home prices than they may have expected, CNBC reports.

“People quite frankly came out and got sticker shock … they picked up the price sheet and saw, ‘Wow, that’s way more than I thought’ because home prices had gone up so much in 2013,” Brad Hunter, chief economist at Metrostudy, told CNBC.

Existing-home prices were up 9.1 percent in February above year ago levels, according to the National Association of REALTORS®. Meanwhile, incomes are up just 2.1 percent from a year ago, according to the Bureau of Labor Statistics.

Down Payment Help for DC Gov Employees

DC is a fantastic city to live in. The DC Government encourages their employees to live in the District through a great incentive: the Employer Assisted Housing Program (EAHP).

EAHP provides assistance to employees of the District of Columbia Government who are first-time homebuyers in the District. Employees of District government agencies may be eligible for matching down payment funds up to $1,500 and a deferred loan of up to $10,000. The maximum allowable purchase price is $417,000. In addition, applicants who apply and qualify for the program receive additional income tax and property tax credits. For more information about this program, go to the Greater Washington Urban League here.

Savvy homebuyers can combine this program with DC Open Doors.